Building finance functions for start-ups and SMEs

Scale your start-up/ SME confidently with financial strategies that ensure financial control and full compliance, preparing you seamlessly for your next growth phase.

Licensed Tax Agent (Zw)

Registered Public Accountant (Zw)

Registered Tax Practitioner (SA)

Corporate Rescue Analyst

150+ start-up & SMEs

impacted

With nearly a decade of technical accounting, tax management, and finance experience in South Africa & Zimbabwe, 150+ start-ups, and SMEs were directly impacted.

Driving financial clarity & business growth

Each business is unique and deserves a tailor-made financial solution that aligns with your goals. Culverwell creates, optimizes, and manages functions by covering the critical financial areas for each business.

Governance, Systems, and Procedures

Tax planning and compliance issues

Corporate Reporting

A new mindset around finance functions

Join hundreds of SMEs and accountants who have transformed their growth journey with our proven strategies.

Tax for Innovators

This course equips entrepreneurs, startup founders, and innovation-driven businesses with the knowledge to confidently handle tax compliance, structuring, and planning within Zimbabwe. Grounded in the Income Tax Act, Finance Act, and VAT legislation, the course covers practical treatments of director fees, deferred income, voluntary disclosures, and efficient entity structuring. The content is adapted from Culverwell’s Innovator’s Guide to Taxation.

Coming soon →

Export Finance and Compliance

This course offers a hands-on framework for understanding the intersection of tax, exchange control, and trade finance for exporting businesses. Drawing directly from the Exporters Guide to Taxation, Exchange Control and Trade Finance, participants are trained in FCA account structuring, export VAT treatment, RBZ requirements, customs compliance, and trade finance instruments such as Letters of Credit and credit guarantees.

Coming soon →

Corporate Rescue for Business Leaders

Targeted at directors, shareholders, and key executives, this course provides clarity on Zimbabwe’s corporate rescue mechanisms, as provided under the Insolvency Act and Companies and Other Business Entities Act. The training draws from the experiences and lessons contained in the Corporate Rescue Procedures and Insights Manual, with a focus on initiating business rescue, creditor negotiations, schemes of arrangement, director responsibility and liquidation avoidance.

Coming soon →

Explore workshops & level up your team

Explore courses designed to sharpen your skills and accelerate your success. Gain practical knowledge to grow your business or career with ease. Join hundreds who have achieved their goals and start learning today!

Success Stories

Discover how our services drive business success and growth. Let our clients' stories inspire your next move!

Working with Culverwell has brought a new level of financial clarity and confidence to UGE Zimbabwe. As our outsourced CFO, Culverwell helped us streamline our reporting and forecasting, enabling us to make informed strategic decisions with ease. It’s been a transformative partnership.

Tax season used to be a headache—until Culverwell came on board. Their professionalism and responsiveness made our compliance smooth and worry-free. We’ve gained peace of mind and more time to focus on growing our solar distribution business.

Culverwell’s support as our finance manager has been critical. From day one, processes were made simple and communication was always clear. We’ve seen better cash flow control, cleaner books, and real financial discipline thanks to their hands-on guidance.

Culverwell Advisory has given Seedsurge a financial backbone. With them acting as our CFO, we’re no longer guessing—we’re planning. Their systems and insights helped us confidently scale our operations while maintaining strict cost controls.

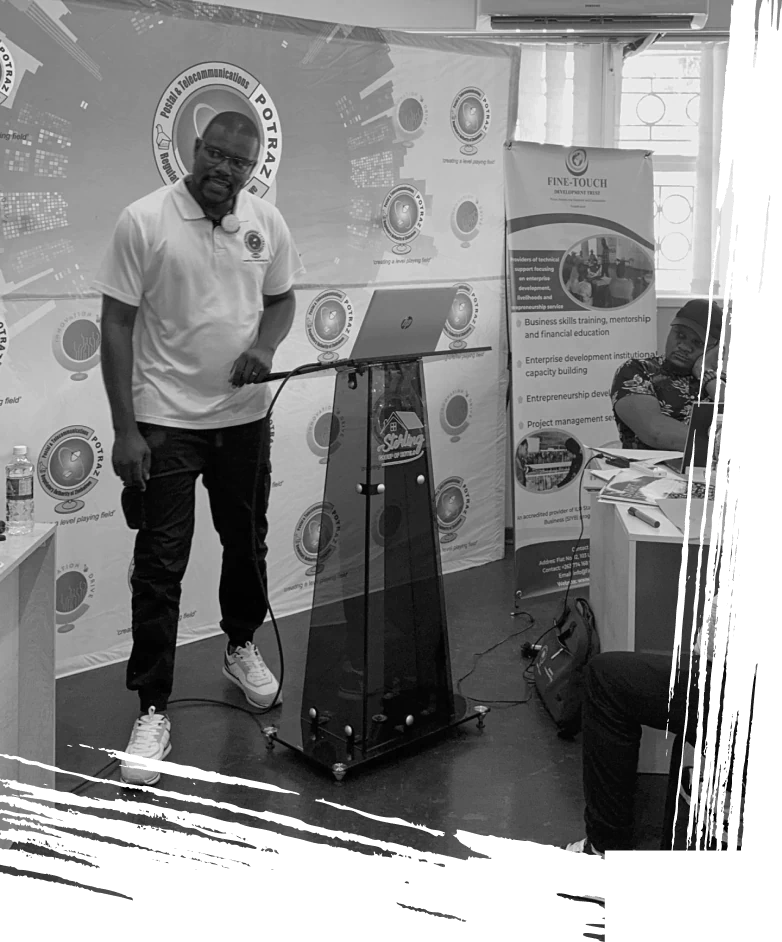

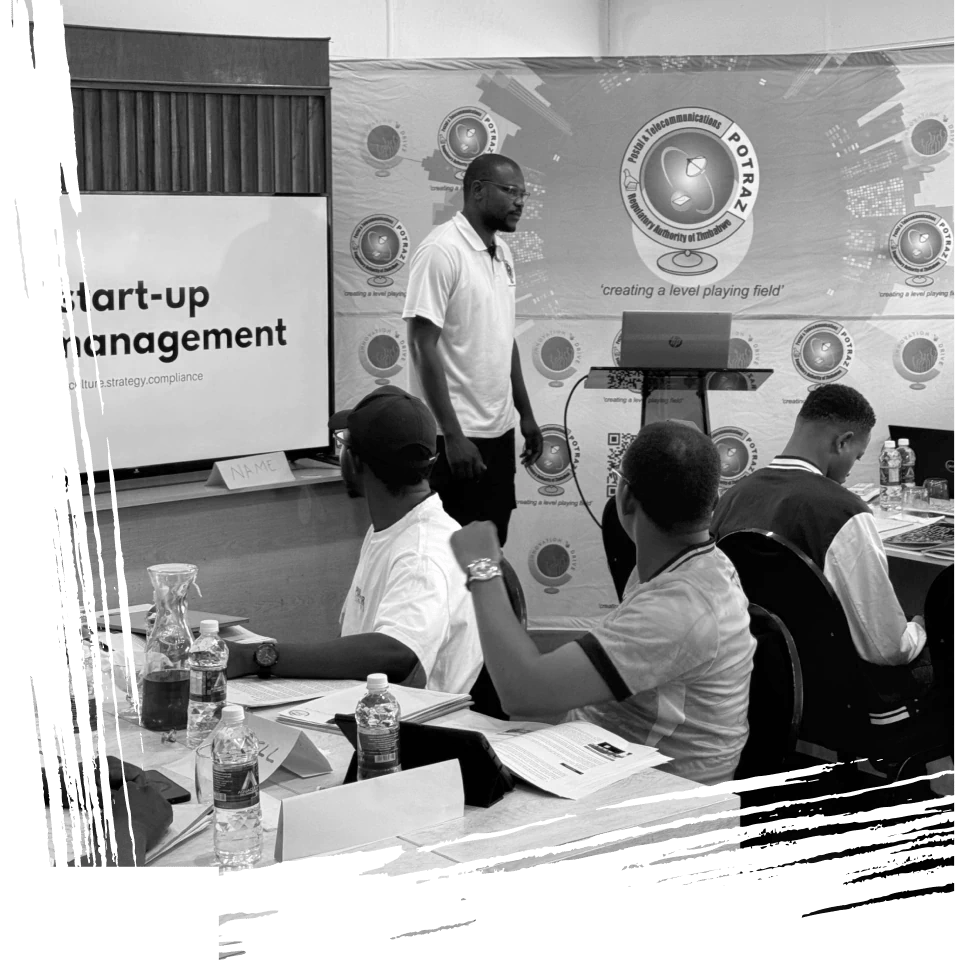

Culverwell’s training for startups under the Innovation Drive was practical, approachable, and incredibly relevant. Founders left the sessions equipped with actionable knowledge and confidence in their tax compliance journey. A great enabler for early-stage success.

As a multi-franchise business in heavy machinery, our operations are complex—but Culverwell made the numbers simple. Their accounting support keeps our books audit-ready and our internal controls solid, freeing us to focus on growth and partnerships.

Since Culverwell took over our tax affairs, it’s been smooth sailing. No surprises, no last-minute rushes—just proactive, clear guidance that keeps us compliant and confident.

Culverwell brought structure to our finances and strategy to our growth. Their tax and financial advice are always timely, understandable, and aligned with our business goals. It feels like having an in-house finance team without the overhead.

Compliance was a major stress point—until Culverwell stepped in. They’ve simplified the entire process, kept us ahead of deadlines, and added financial reporting that’s helped us spot new growth opportunities. Highly recommended for any fast-moving company.

Articles & Insights

Our articles provide valuable knowledge to keep you ahead and make informed decisions. Explore the latest updates and strategies